As the dust settles from the whirlwind that was the Octane Aesthetics Tech Forum, immediately followed by JPM week, I took a brief moment to reflect on my insights gained from 2024 while looking ahead to 2025.

While 2024 was a bumpy road for the aesthetics industry and a down year overall for startup investing, the outlook for 2025 looks overwhelmingly positive on both fronts.

Despite a slight dip in consumer behavior in 2024, the aesthetics industry rebounded with a steady growth trajectory – with a particular emphasis on personalized regenerative aesthetics, the integration of wellness, a desire for longer-lasting and more natural-looking aesthetic results, and a greater desire for minimally invasive procedures. There’s no doubt that GLP-1s are a key driver of aesthetic activity, both in the skin-tightening arena, but also in expanding the general aesthetics market as new consumers step into this space. This growth is coupled with the continued increasing demand driven by social media and the “zoom effect.”

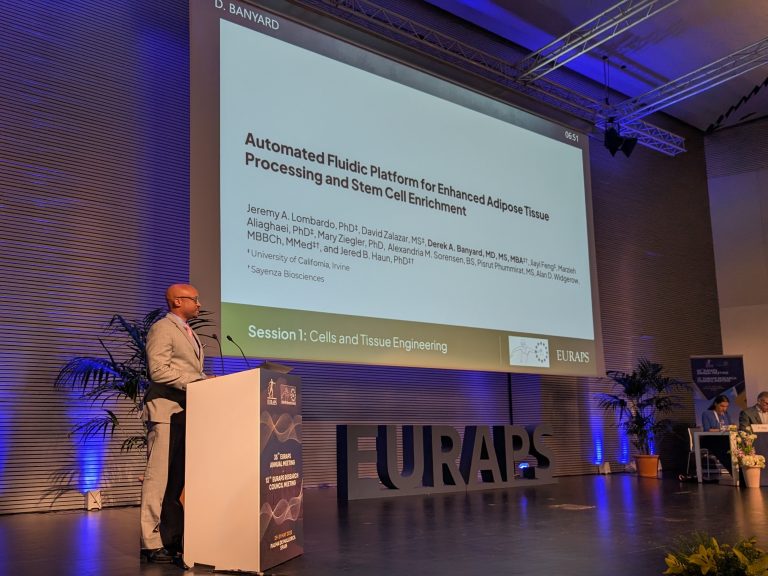

One notable trend in 2024 was consolidation and a shift in focus for some of the competitors in our space. Sientra was acquired by Tiger Aesthetics, which looks poised to grow their share of the breast implant business while also increasing their holdings of regenerative medicine offerings. Similarly, Bimini Health Tech acquired The Ideal Implant to grow their presence in breast reconstruction. These shifts in emphasis leave a void in the adipose therapeutics space that Sayenza is well-positioned to fill!

Following my return from San Francisco and JPM Week, I can confidently say that 2025 is going to be an active year for life sciences and startup investing! The overwhelming sentiment I heard from friends and colleagues was that this was one of the best and most positive JPMs in recent history. I, too, had very positive meetings with investors and potential partners, and I can’t wait for what’s to come next!